This post might be very ‘Australia’ orientated, but I am going to make some obvious observations about timing, tax, and the ZineQuest Kickstarter I ran in February this year. In Australia the financial year runs from July one year to June the next. ZineQuest ran in February. My Kickstarter project for ZineQuest launched on the 1st of February, and ended on February the 16th, funding successfully. Kickstarter takes time to gather rewards, chase backers who declined or didn’t pay, and generally process things, and in the end the money raised by the Kickstarter landed in my account on the 2nd of March, about two weeks after the project had ended. It should also be noted here that the amount pledged and the amount received by the project creator are not the same thing. Kickstarter takes it’s 5% fee, and there are additional processing fees which typically round the amount up to around 10%, and then there are dropped backers and refunded backers. Dropped backers are those who pledged an amount of money, and then who, for whatever reason, didn’t pay.

To give a quick and dirty break down using my Kickstarter as the example:

Corsairs funded on February the 16th, with 236 Backers pledging $4116 AUD.

Dropped Backers amounted to -$76, leaving the amount gathered by Kickstarter at $4040 (an ominous number 😀 )

Kickstarter fees amounted to about $202 and processing fees of a further $167.

Meaning that, after all else, Corsairs resulted in a deposit into my account from Kickstarter for roughly $3671 (yes, I am sanding off the cents throughout).

INSERT OBLIGATORY PLUG:

If you don’t have a copy of Corsairs you can fix that by heading to DriveThruRPG or Itch.io. If you missed the Kickstarter and are interested in a physical copy of the zine, there are still some physical copies left, contact me at caradocgames@gmail.com for details.

The supplement, Smoke and Oakum, is also available at DriveThruRPG and Itch.io now!

END OBLIGATORY PLUG.

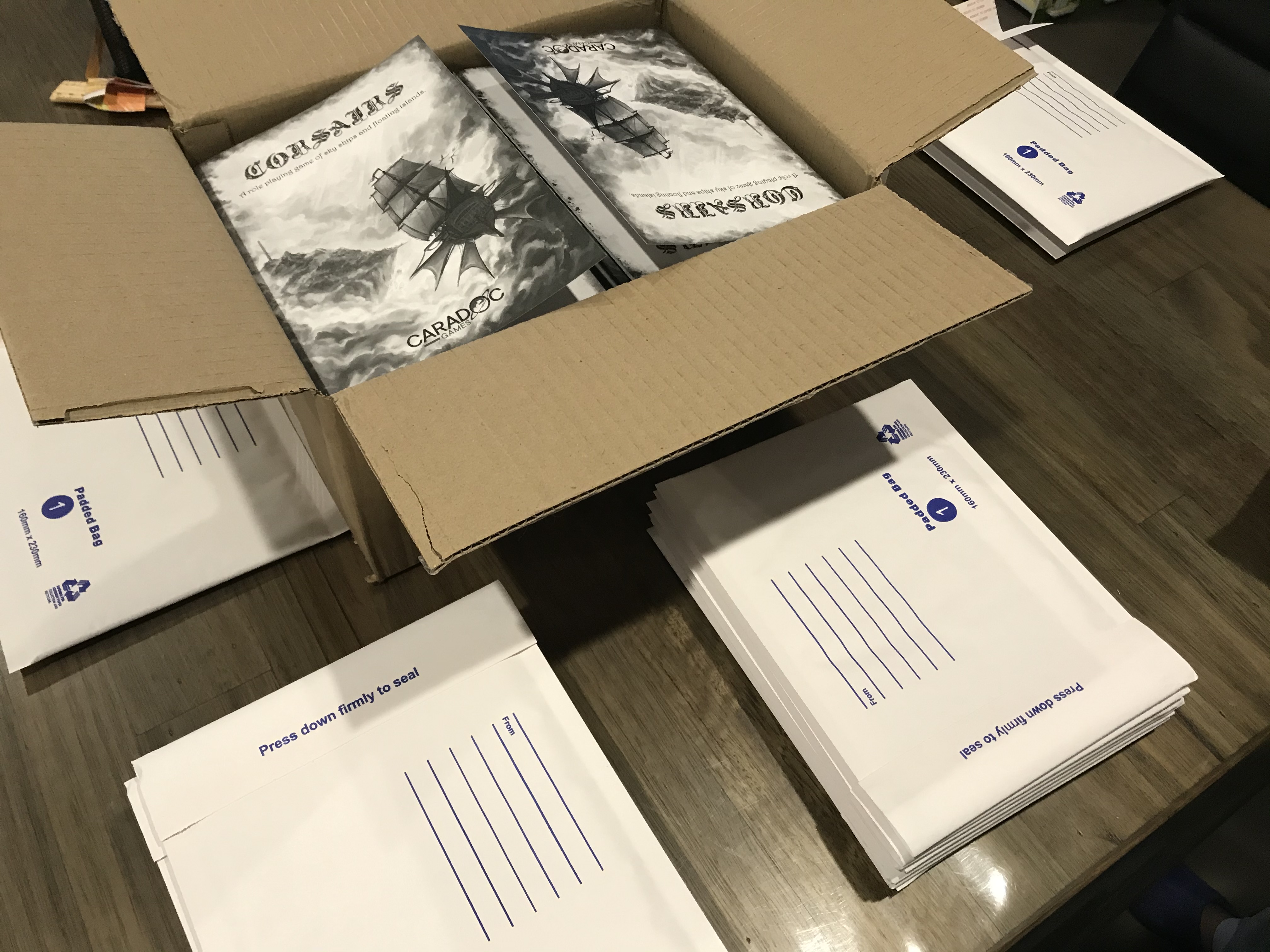

Out of this I obviously had to pay for everything, from art to printing and shipping. Shipping was the largest expense by far, and cost a little over $1100 on its own. Aaaaannnndddd this is the thing that I think I am going to try and remember for the next time…

With the money hitting my account at the start of March, and the end of the financial year sitting at the end of June, the money raised by the Kickstarter was going to sit in the 2019/2020 taxable year. Between art, printing delays, and Covid, I ended up having Corsairs printed and shipped to me at the start of August, and then shipped out to my backers in the middle of August. Meaning the printing and shipping costs of more than $1600 would be counted as an expense in the 2020/2021 financial year.

Why is this relevant? It’s about the taxable income for any given financial year, in an ideal scenario I would have had the game printed and shipped before the end of the 2019/2020 financial year in June 2020 in order that the costs of printing and shipping would count against the income from the Kickstarter as an expense, and reduce the taxable income of my business.

Now, I fully understand we are talking small amounts of money here compared to almost every other kickstarter or business. But timing, as best as is possible, the expenses element of a Kickstarter so that the income does not look artificially inflated to the tax office is really worth planning for.

Yes, I had an income from the Kickstarter of over $3600, but that didn’t account for multiple expenses (art, printing, shipping labels, envelopes, shipping, and everything else). The tax office don’t care what expenses are upcoming though, that’s for the next financial year, all that matters is what happens between the start of July 2019 and the end of June 2020. Now, perhaps there is an advantage to the fact that my business has already racked up a bunch of expenses for the 2020/2021 financial year, and that may be useful when it comes to the (fingers crossed) ZineQuest in 2021 and lodging my tax return for the 2020/2021 financial year, but thinking about the timing of income and expenses is something I am much more aware of now than I was back in January of this year. This might be especially true if you are running a Kickstarter or making money from your creative work in addition to a day job, and your income is already close to a tax threshold.

Dull talk, and perhaps very Aussie-centric, but some further thoughts following my experiences this year with the ZineQuest.

This article is a part of a series about running a Kickstarter campaign for ZineQuest, you can find the other articles in this series here.